|

| |

The Brode Report | November 2011

|

|

The year's flying by, and I'm excited about joining my sister and her family in Whistler, BC for Thanksgiving and to kick off my ski season. Hope you all enjoy the break.

Of course I hope you enjoy the Groupon Corner section of the newsletter as that story continues to fascinate me. At this point it's wait and see for company results and an exercise in watching how markets anticipate and react.

|

But the main topic today is about Dropbox, which is both hugely popular and highly valued. I'm betting a good tale is setting up, so just like with Spotify I want to lay the groundwork for discussion.

All the best,

David

|

|

|

| |

|

| |

| |

Got a complex analytical question?

Or just a simple Excel question that gives you an excuse to call and catch up?

Call me at (303) 444-3300 or connect with me on LinkedIn.

|

|

| |

|

| |

Dropbox Pops to $4B

Cloud-Based Storage

I'm sure you've seen it by now. Dropbox looks like another folder on your computer, but it's actually storing files in the cloud (Amazon's EC3 cloud, truth be told). Since it's in the cloud you can share the folder with others or access it from your home computer or your smartphone. The user interface is very simple.

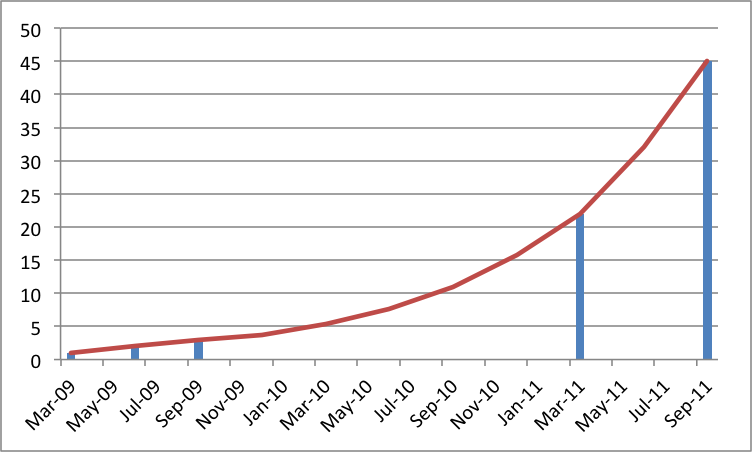

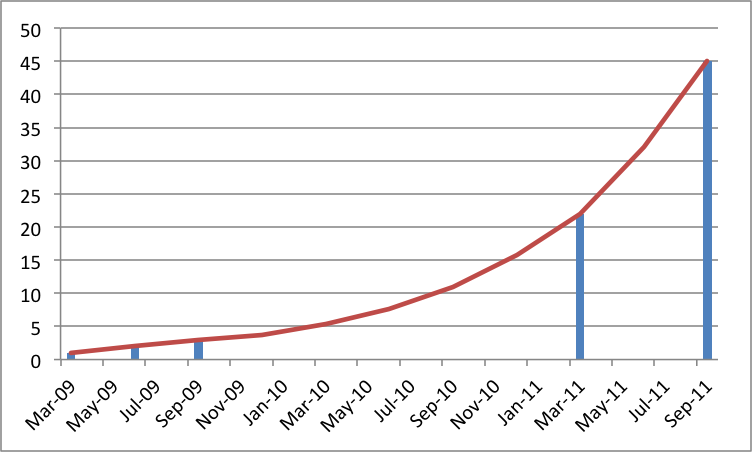

Exponential Growth

It's popular: subscribers (in millions) shown below. The red line was generated from five data points represented by the blue bars. Dropbox is currently experiencing exponential growth.

Fund Raising and Valuation

Dropbox is another of the new kids sporting billion-dollar valuations. Their funding history is even more explosive:

- 2007: $1.2M in debt from Sequoia.

- Nov-2009: $7.25M Series A. (They reportedly turned down a "nine-figure" (i.e. over $100M) offer from Steve Jobs this year as well.)

- Oct-2011: $250M Series B at $4B valuation.

My question, of course, is how to justify the valuation or even a 50-100% premium on that so that the investment pays off. More on that later.

Freemium Economics

Dropbox's business model is called "freemium" pricing because they give away the product while limiting the functionality and charge for increased capabilities. Spotify, which I wrote about last month, is another freemium pricer. Dropbox gives users 2G of storage space (similar in size to a USB flashdrive) and charges $10/mo for 50G of storage, which is a truly useful amount for putting a significant portion of your digital life in the cloud.

The great thing about this business model is that customers get to try out the service and get hooked. The barrier to becoming a customer, especially a free customer, are incredibly low. So the first question I have is how many free customers can be supported by one paying customer? One detailed analysis I saw indicated that Dropbox's gross margins are approximately 90%. This suggests that the 50G account costs them about $1/mo, or $0.02/Gb/mo. So if they are making $9/mo in gross margin, then one user can pay for 450 Gb of other storage, or enough for 225 free users. That's pretty impressive. Since current estimates are at about 30 free users for every paying user, Dropbox should have positive and significant gross margin. It's unsurprising that you can make lots of money when you mark up 10x from your marginal costs!

So with freemium customers, the key is the cost of acquiring a new free customer and your efficiency at converting customers to paying. Data suggests Dropbox converts 3.4% of their customers, and that ties out well with the 30 free customers per paying customer.

It turns out that this works very well for Dropbox: they still have gross margin of 78% even after the free customers are paid for. And each paying customer is worth nearly $200.

| |

Single Paying Customer Economics |

|

| |

Rev/Cust/mo | 10 |

|

| |

| |

|

| |

Free Custs/Paying Cust/mo | 30 |

|

| |

| |

|

| |

GB/Paying | 50 |

|

| |

GB/Free | 2 |

|

| |

GB | 110 |

|

| |

| |

|

| |

Cost/GB/mo | $ 0.02 |

|

| |

| |

|

| |

| per Mo |

|

| |

Rev | $ 10.00 |

|

| |

COS | $ 2.20 |

|

| |

GM | $ 7.80 |

|

| |

| |

|

| |

Avg Life | 24 |

months |

| |

Cohort Value | $ 187.20 |

|

And things are only getting easier for Dropbox. The economics of shared ecosystems suggests that it will only be easier to acquire customers. For example, I signed on because someone wanted to share a folder with me. Viral expansion at its best.

Yes, competition will be coming. But it looks like Dropbox has the scale to at least be a player in the game for corporate data. Are they worth $4B? We'll save that for a future newsletter.

|

|

|

| |

Groupon Corner

The big news of course was GRPN's IPO. The market hath spake, and given them a $15B valuation. It's not $30B, for sure, but still feels high to me.

But it may not stay high for long. The Financial Times reported that:

| | "Almost all the shares that can be borrowed are out on loan, meaning it would be hard to short more of the stock. Investors are prepared to pay the highest fee to borrow the stock before shorting it." |

On the lighter side, I did enjoy this lovely poem about Groupon: http://www.thereformedbroker.com/2011/10/30/groupoem/.

|

|

|

|

|

| The Brode Group |

Strategic Financial Consulting - Real-World Results |

(303) 444-3300 |

|