Where Has NPV Gone?

Is NPV in decline? In the last year Iíve worked on forecasts ranging from more ethereal Internet-enabled services such as marketplace platforms and SaaS offerings to infrastructure-intensive telecom all the way down to natural resources, and I had only one client that was interested in calculating net present value (NPV). Maybe Iím just seeing a small sample size, but Iíve even taken my DCF valuation module out of my base model due to lack of interest. Is NPV in decline? In the last year Iíve worked on forecasts ranging from more ethereal Internet-enabled services such as marketplace platforms and SaaS offerings to infrastructure-intensive telecom all the way down to natural resources, and I had only one client that was interested in calculating net present value (NPV). Maybe Iím just seeing a small sample size, but Iíve even taken my DCF valuation module out of my base model due to lack of interest.

NPV gives the right answer. I find it amazing that this must be reiterated. But if Iím seeing less use of NPV, then less financially-minded folks probably never see it. I absolutely believe in the ďtruthĒ of NPV. Marakon Associates – and many others – have arrayed evidence showing that the capital markets really do work off NPV principles for large cap companies. Itís a staple of corporate finance textbooks.

Investors and executives resist using NPV.  The Wall Street crowd has long focused on ďcomparableĒ measures, typically multiples. The more frothy the market, the further away the underlying metric moves from cash flow to net income to EBITDA to revenue to users. The Whatís App transaction was explained in the financial press based on $/user. The Wall Street crowd has long focused on ďcomparableĒ measures, typically multiples. The more frothy the market, the further away the underlying metric moves from cash flow to net income to EBITDA to revenue to users. The Whatís App transaction was explained in the financial press based on $/user.

Investors focus on IRR and cash-on-cash multiples. We still have a financial forecast, but for investment analysis (almost) all that matters is the final year EBITDA because the exit for the company is based on an EBITDA multiple. When you combine that with the valuation when an investor enters the deal, you can quickly calculate a 53% IRR and 9.5x multiple.

Arbitrary IRR or cash multiple hurdle rates lead to bad decision-making. Some investors set a 40% hurdle rate. Maybe they used it when interest rates were at 8%, but does that make sense when rates hover around zero? My issue is that these alternate measures cause good deals to be rejected. And some especially risky deals can be green-lighted when they should be shelved. Arbitrary IRR or cash multiple hurdle rates lead to bad decision-making. Some investors set a 40% hurdle rate. Maybe they used it when interest rates were at 8%, but does that make sense when rates hover around zero? My issue is that these alternate measures cause good deals to be rejected. And some especially risky deals can be green-lighted when they should be shelved.

People get hung up on NPVís discount rate. One great thing about multiples and IRR is that you donít have to agree upon a discount rate. Back in the day we would use the Nobel Prize-winning Capital Asset Pricing Model (CAPM) to calculate the discount rate (i.e. the cost of equity, or Ke) as Ke = Kf + Beta x MRP. One difficulty with that in early stage companies is that (1) Kf is so low right now and (2) Beta is durn hard to measure for an early stage company. Then you wind up needing a ridiculous beta to get a Ke that seems credible. It doesnít help to choose a high discount rate, like 20%, either. Consider a case where you had to invest $1 million this year and next year. Would you consider next yearís $1 million investment to be worth only $833K to you today? Not likely. The counterintuitive but correct answer is to stick with CAPM and a relatively low discount rate.

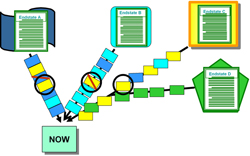

The real solution is to consider multiple scenarios. Everyone  wants to see the success case for the new enterprise. Itís valuable to see what assumptions you need to believe in order to achieve high returns. But everyone knows that every company doesnít grow like a hockey stick. Really, we need to have different scenarios: one where the company fails in Year 2, one where thereís a middling exit in Year 5, and so on. If we weight the probability of each scenario occurring then we can get weighted average expected cash flows, and NPV can total up the answer. Then the question becomes whether the overall NPV is greater than zero. wants to see the success case for the new enterprise. Itís valuable to see what assumptions you need to believe in order to achieve high returns. But everyone knows that every company doesnít grow like a hockey stick. Really, we need to have different scenarios: one where the company fails in Year 2, one where thereís a middling exit in Year 5, and so on. If we weight the probability of each scenario occurring then we can get weighted average expected cash flows, and NPV can total up the answer. Then the question becomes whether the overall NPV is greater than zero.

Itís all a matter of where to account for risk. You can do it implicitly in a high hurdle rate, or by considering the likelihood of different outcomes. This may not be easy work, but it could be the way you get an edge in a world where others are taking shortcuts.

|

|

|

Excel Master Tip: Excel Master Tip:

Partial Formula Evaluation

Perhaps youíve seen a cell display a number that doesnít make sense to you. So you stared at a long formula and wondered how that formula delivers that result. One trick I use is to evaluate the formula bit by bit.  Few people take advantage of this alternate use of F9. Watch the video to see how — itís *very* easy and very useful. Few people take advantage of this alternate use of F9. Watch the video to see how — itís *very* easy and very useful.

Terminal Value Calculations

In writing the main NPV article, I remembered how we used to geek out at Marakon over deriving the terminal value equations. Early in my solo consulting career I recreated that math and struggled with  Wordís equation editor so others didnít have to struggle to read my messy handwriting. The results are in this PDF file. Wordís equation editor so others didnít have to struggle to read my messy handwriting. The results are in this PDF file.

|